Spark PMS - Focused on Smallcap Stocks

Faster growth from small-cap and quality companies

Faster growth from small-cap and quality companies

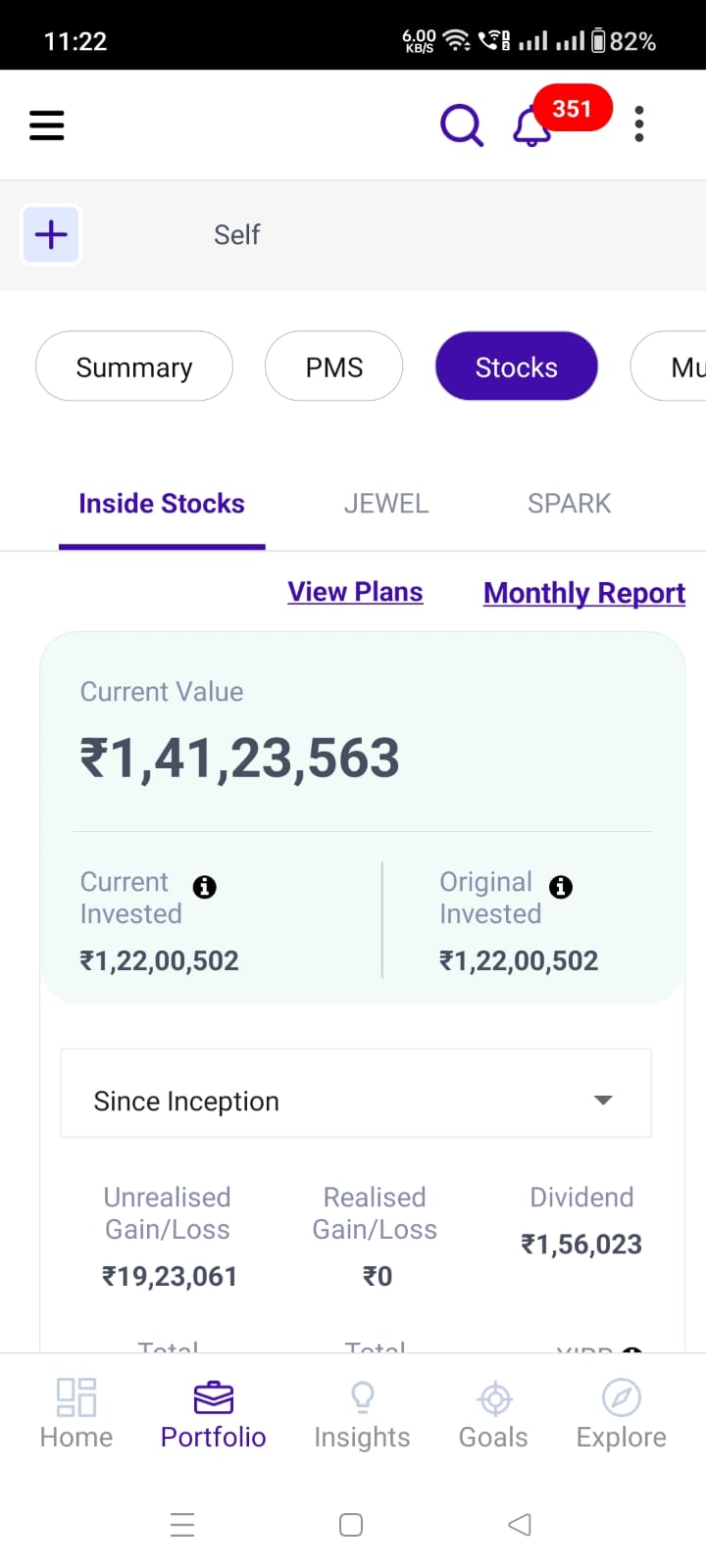

Small-cap stocks have a high growth potential. With Maxiom Wealth Spark PMS, capitalise on opportunities as India rises in the world.

Our seasoned professionals research into the nuances of small-cap equities tapping their decades of experience of working ‘inside’ the industry.

We curate the portfolios across sectors spreading risk and maximising returns. Focus is on manufacturing, technology and other rising industries.

With Spark PMS, experience a balanced approach that safeguards against market volatility. Stocks that dont meet quality criteria are exited.

We recommend an allocation of 15% to 50% of long term portfolio to this asset class. This of course depends on your risk profile covering both risk appetite and risk tolerance.

We adhere to “Roots & Wings” . Roots = Strong balance sheets, consistent ROE/ROCE, aligned promoters. Wings = Growing Financial trajectory.

We study the 'smaller' 650 of top 1000 businesses These are already scaled companies with an average market cap of ₹4000 to ₹5000 crores ($500m). Many research houses do not cover them.

Every investor is unique. We are able to tailor portfolios that reflect investor constraints, risk appetite and financial aspirations. This is helpful for CEOs, CXOs or industry leaders with existing large sectoral exposures

The dynamic nature of the stock market necessitates regular portfolio adjustments. We keep portfolios aligned (including transaction management) with the market developments and company performances as reflected in their quarterly results.

With proactive strategies, we ensure client investments are resilient against market uncertainties. Stocks that do not meet the stringent quality criteria are placed on 'watch' or are exited. Our Fund Manager is available for allaying any concerns.

Focus on long-term capital appreciation through investments in small-cap companies with strong fundamentals and high growth potential.

Adherence to the Roots & Wings philosophy, targeting companies with low debt and consistent ROE/ROCE.

We stick to a proven investment philosophy and processes that ensure decisions are consistent and free of emotional bias.

Attention to early risk indicators and periodic review for portfolio churn decisions.

The next 650 universe is not covered by many institutions. This gives us opportunity to select stocks with untapped potential.

We depend on our proprietary data analytics, keeping third-party influences at bay.

Small-cap stocks can offer significant growth. We help you tap into this potential.

Our strategic approach to small-cap equities maximises returns and minimises risks.

Our focus on wealth creation aligns with your success, avoiding harmful products.

Leveraging our proprietary platform, we rate stocks and mutual funds without bias.

Our deep expertise, combined with proprietary data analytics, guides our selection. Each pick aligns with our commitment to growth and safety.

While they can be volatile, our diversified and risk-controlled approach ensures a balanced portfolio to navigate market challenges.

Regular rebalancing is key. We adjust portfolios in line with market dynamics and your financial goals. This happens atleast once quarterly.

Absolutely. As a SEBI Registered PMS, we do not hold your stocks or funds. These are under the custodial services of a large and reputed bank.

Our expert management curates a mix of promising stocks, ensuring diversification to spread across sectors, sub-market-cap-classes and manage risk.

Our holistic approach, from financial planning to execution, combined with our unique features and client-centric value system, sets us apart.